How To Secure Yourself From Authorizing A Poor Mortgage Agreement

Created by-Steenberg Swanson

The greatest things in your life aren't all going to be easy to get. It isn't always easy to find the home mortgage that is financially right for you. You have to know what you're looking for and have a lot of patience. Put the advice you will learn to use, ensuring you get a great deal on your home mortgage.

Avoid accepting the largest loan amount for which you qualify. You are the best judge of the amount you can afford to borrow. The lender's offer is based only on the numbers. Consider your life, how your money is spent, and what you can afford and stay comfortable.

Organize your financial life before going after a home mortgage. If your paperwork is all over the place and confusing, then you'll just make the entire mortgage process that much longer. Do yourself and your lender a favor and put your financial papers in order prior to making any appointments.

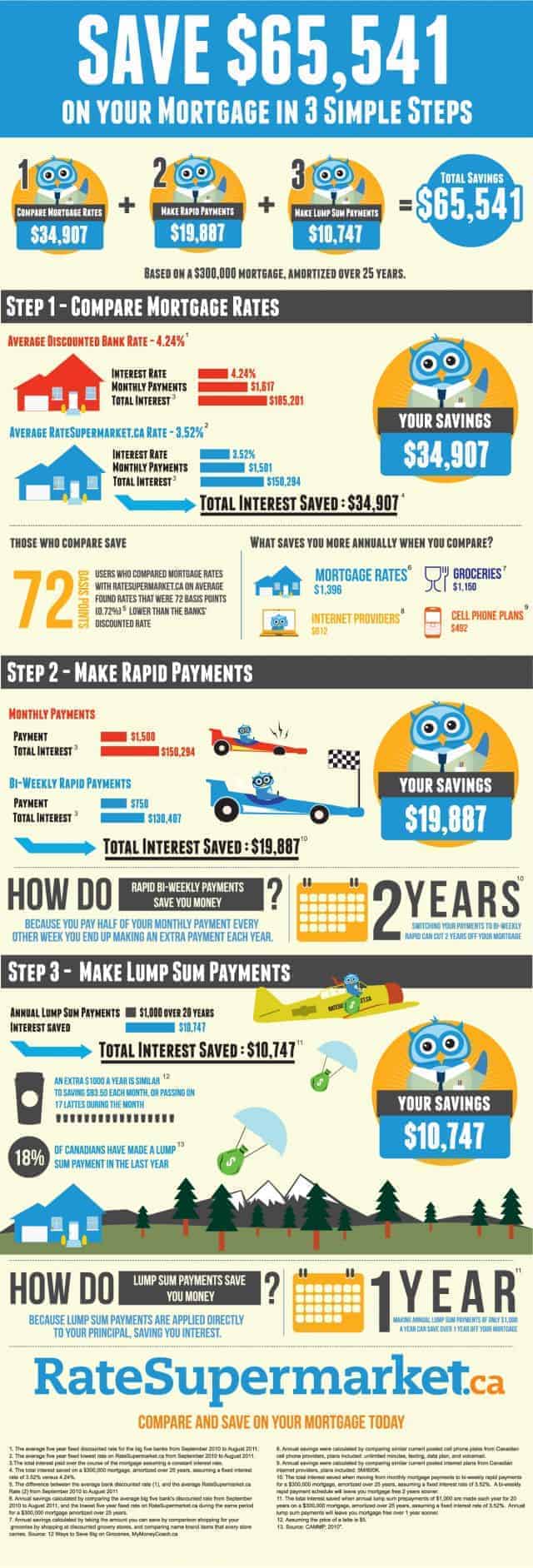

Try shopping around for a home mortgage. When you do shop around, you need to do more than just compare interest rates. While they're important, you need to consider closing costs, points and the different types of loans. Try getting estimates from a few banks and mortgage brokers before deciding the best combination for your situation.

If your financial situation changes, you may not be approved for a mortgage. It's crucial that you are in a secure job position before getting a loan. Don't accept a different one until the mortgage is approved since the lender makes their decision based on what's in your application.

When considering the cost of your mortgage, also think about property taxes and homeowners insurance costs. Sometimes lenders will factor property taxes and insurance payments into your loan calculations but often they do not. You don't want to be surprised when the tax office sends a bill and you learn the cost of required insurance.

If you are a veteran of the U.S. Armed Forces, you may qualify for a VA morgtage loan. These loans are available to qualified veterens. The advantage of these loans is an easier approval process and a lower than average interest rate. The application process for these loans is not often complicated.

Have the necessary documents ready. There are a few documents that you'll be expected to have when you come in for a home mortgage. You'll need to provide bank statements, income tax reports, W-2 statements, and at least two pay stubs. Having these at the ready will help make your meetings go much quicker.

When trying to figure out how much of a mortgage payment you can afford every month, do not neglect to factor in all the other costs of owning a home. There will be homeowner's insurance to consider, as well as neighborhood association fees. If you have previously rented, you might also be new to covering landscaping and yard care, as well as maintenance costs.

Make sure you look at multiple mortgage lenders before settling on one. You definitely need to do some comparison shopping. There are a lot of different mortgage rates and deals out there, so stopping at just one could really mean wasting thousands of dollars over the life of your mortgage.

If you're having trouble getting approved for a mortgage, consider purchasing a fixer-upper home, rather than your first and most expensive choice. While this means spending a considerable amount of time and money, it may be your best option in qualifying for a mortgage. Banks often want to unload fixer-uppers too, so that also will work in your favor.

Do not embark on browse around here of buying a home if you have just started a new job within the last year. The best home mortgage rates go to those that have been with a company for a number of years. Having a job for a short time is seen as a risk, and you will be the one to pay for it with a higher interest rate.

Shop around for mortgage refinancing once in a while. Even if you get a great deal to start with, you don't want to set it and forget it for several decades. Revisit the mortgage market every few years and see if a refinance could save you money based on updated insurance rates.

Don't choose a variable mortgage. As the economy changes, the rates of your loan will change as well and it can cost you a lot more in interest fees. An extremely high interest rate could make it impossible for you to afford your monthly payments.

If you have a little bit more money to put down on a home, consider getting a conventional mortgage as opposed to an FHA mortgage. FHA mortgages have lower down payments, but excessive fees that are added to the cost of the mortgage. Save up at least 5 percent in order to be eligible for an FHA loan.

Before signing on the dotted line of your home mortgage, learn about the history of the property you are purchasing. There are many things sellers and lenders are not required to disclose that you might find relevant. knowing whether or not your new home was the scene of a gruesome murder might be something you want to know before agreeing to buy.

The best way to be sure that you take a mortgage which will continue to be easy to pay off in the future is to take less than the maximum amount you are offered. If you have some extra money at the end of the month, you can put it away into an emergency fund instead of your mortgage.

Ask Highly recommended Internet site in advance what documentation they need before you meet with them. This is usually going to include tax returns, income statements and W2s, although more might be needed. The more time you have to get it all together is the less likely you'll be unprepared at the actual meeting time.

Do not hesitate to wait for a more advantageous loan offer. There are actually certain months and seasons where getting a loan is better for you. Additionally, you may get a better deal if new laws are passed. Bear in mind that sometimes, good things really do come to those who wait.

Figuring out what goes into getting a mortgage is something that can be important. You never want to wind up with your head underwater, struggling just to get by with a mortgage you can barely afford. You should seek a home mortgage that is more favorable to your financial situation, and go with a lender who will do right by you.